When it comes to money, we’re all making decisions every day—big and small—that shape our financial future. But the difference between struggling and thriving often boils down to how informed those decisions are. Having solid financial knowledge and strong decision-making skills can empower you to solve problems, think critically, and navigate money matters with confidence. Whether you’re tackling debt relief or planning for your next big purchase, understanding the essentials makes all the difference.

Here’s what you need to know about the value of making informed financial decisions and how it can improve your money life.

Why Financial Knowledge Matters

Money management isn’t just about numbers; it’s about understanding how those numbers work and what they mean for your goals. Financial knowledge covers everything from how interest rates affect loans to the basics of budgeting and saving.

Without this foundation, it’s easy to get overwhelmed or make choices that don’t serve you well. For example, when dealing with debt relief options, knowing your rights and the types of programs available helps you avoid scams and pick the best path.

Informed financial decisions come from understanding these concepts and applying them in your daily life.

Critical Thinking and Problem-Solving: Tools for Financial Success

Making smart money decisions requires more than facts—it calls for critical thinking and problem-solving skills. Life throws unexpected challenges at us, and the ability to analyze options, weigh pros and cons, and foresee consequences is invaluable.

Say you’re deciding whether to take out a loan or use savings for a big expense. By evaluating interest rates, payment terms, and your budget, you can choose the option that minimizes costs and fits your goals.

These skills also help when facing financial setbacks. Instead of panic or avoidance, you can calmly explore solutions, like negotiating with creditors or adjusting your budget, and take control of your situation.

The Power of Asking Questions

Informed decision-making starts with curiosity. Don’t hesitate to ask questions about financial products, fees, and terms. If something isn’t clear, seek clarity before committing.

This mindset protects you from surprises like hidden fees or unfavorable loan terms. It also empowers you to compare options and make choices based on facts, not pressure.

Whether you’re exploring debt relief or investing, asking the right questions is a habit that pays off.

Building Your Financial Literacy

Improving your financial literacy is a lifelong journey. There are plenty of resources available—from online courses and workshops to books and podcasts—that can help you build knowledge gradually.

Start with basics like understanding credit scores, budgeting, and saving strategies. Then, move on to more complex topics like investing or tax planning.

The more you learn, the easier it becomes to spot opportunities and avoid pitfalls.

How Informed Decisions Affect Your Financial Future

Every choice you make has ripple effects. Informed decisions help you avoid costly mistakes, reduce stress, and stay on track toward your goals.

For example, understanding how credit card interest compounds might motivate you to pay off balances sooner, saving you money. Knowing the benefits and risks of debt relief programs allows you to choose options that genuinely improve your financial health.

Making decisions with knowledge and care creates a positive feedback loop—good choices build confidence and better opportunities.

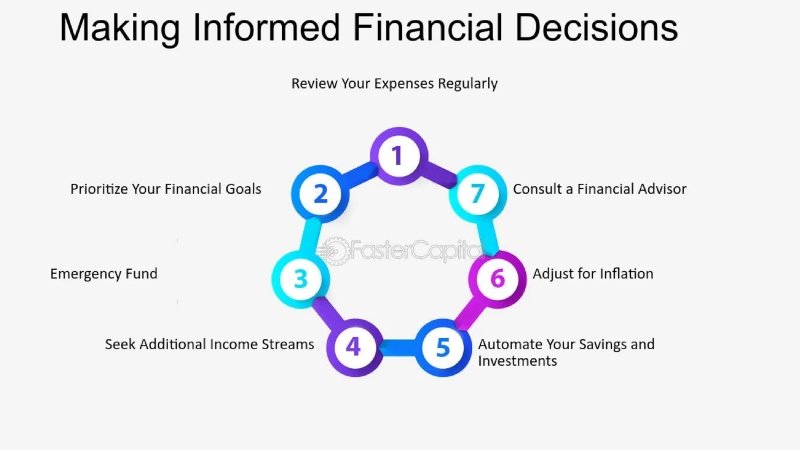

Practical Tips for Becoming a Savvy Financial Decision-Maker

- Stay curious: Regularly read and learn about money topics.

- Track your finances: Knowing where your money goes helps you make smarter choices.

- Ask for help: Financial advisors or credit counselors can offer personalized guidance.

- Evaluate your goals: Keep your financial objectives clear to guide decisions.

- Avoid impulsive decisions: Take time to review options before committing.

Final Thoughts: Empowerment Through Knowledge

The value of making informed financial decisions goes beyond saving money. It’s about empowerment, confidence, and control over your financial life. Whether you’re navigating debt relief or planning for the future, knowledge combined with critical thinking creates a solid foundation for success.